«Slay The Princess» — combinatorial narrative

My favorite version of the Princess.

It's hard to impress me as a player and even harder as a game developer. The last time it happened with Owlcat Games in Pathfinder: Kingmaker, when they added a timer to the game's plot.

But Black Tabby Games managed to do it. And they did it not with some technological complexity but with a visual novel on a standard engine (RenPy), which is cool in itself.

I'll share a couple of thoughts about the game and its narrative structure, while I'm still under the impression. I need to think about how to adapt this approach to my projects.

ATTENTION: SPOILERS!

If you haven't played Slay The Princess yet, I strongly recommend you to catch up — the game takes 3-4 hours. You'll not regret it.

About the book "The Net And The Butterfly"

I bought "The Net And The Butterfly" by mistake when I was in St. Petersburg about 5 years ago and organized a book-shopping day. I bought about 10 kilograms of books :-D, grabbed this one on autopilot without reading the contents. I thought the book would be about the network effect and the spreading of ideas, but it turned out to be about how to "manage" a brain relying on one of the neural networks in it. Which network? For the book and its content it does not matter at all.

My opinion of "The Net And The Butterfly" is twofold. On the one hand, I cannot deny its usefulness, on the other… the material could have been presented 100 times better and 3 times shorter. Sometimes, the authors walk on thin ice and risk falling into information peddling/marketing fraud.

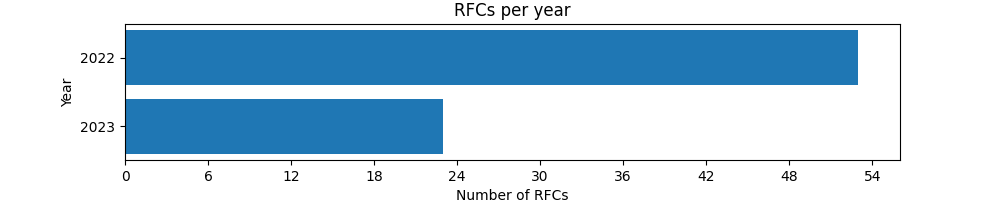

Two years of writing RFCs — statistics

Slightly more than two years ago, I became a Lead/Engineering Manager for Palta's payment team. I left the company at the end of 2023 for another sabbatical [ru].

It is time to sum up. I will start with my favorite initiative.

From the first month, I promoted the idea of preceding major changes with text documents — RFC — Request for Comments.

In this post, I will analyze two years of applying this practice to share the experience, summarize the results, and have convincing arguments for my next job.

Procedural news headlines without complex text generation

A screenshot of the interface for selecting a news connotation (from the prototype of the game about a news agency). News: the arrest of a teenage witch for drunk driving.

From the player preference survey, I gradually moved on to working on a game prototype.

The game will be about a news agency. You will be the chief editor, and your task is to manipulate public opinion by investigating events and choosing a connotation of news: where to draw the public's attention, what to hide, in what tone to present themes, etc.

Therefore, the whole game will be around the text of news.

Creating large blocks of detailed text for each news item looks pointless — the game is not about reading news but about managing them. Therefore, it makes sense to build interaction only around headlines.

But how can we make the displaying of news both interesting and simple?

About the book "Economics: The User's Guide"

Cover of the book "Economics: The User's Guide"

This is the second book by Ha-Joon Chang that I've read. The first one, Bad Samaritans [ru], left a good impression, and it was also positively reviewed by Tim O'Reilly in his book WTF? [ru]. So, "Economics: The User's Guide" took its place on my reading list, and finally, I have read it.

Here and further, all quotes point to the Russian edition of the book and are translated into English by me (I have only the Russian edition) => inconsistencies are possible because of double translation English->Russian->English.

According to Chang, the book was conceived as an "introduction to economic theory for the widest possible audience" (page 299), and this reflects its essence well. I would only add, from the perspective of my post-Soviet education, that the book looks more like an "overview of the diversity and complexity of economics, supplemented with an introduction to the theory" rather than an "introduction to the theory".

The book contains no mathematical formulas or jaw-dropping statistics, just concrete facts. What makes it valuable, however, is a set of prisms through which you can — and should — view the economy to gain a basic understanding of what's happening around you.

Chan provides a set of points of view through which you can examine economic processes; describes their advantages and disadvantages; accompanies all this with examples, historical references, and facts.

Since the book serves as a sort of textbook, I won't attempt to retell it in full — this would lead to an attempt to repeat the book in a couple of pages, and I definitely can't do that. I will limit myself to describing the author's view of the economy as a whole as I understood it.